Because of my vocal opposition to Don Estep as Kentucky Overseer and my posting of documents I believe bolster my opposition, I have been called to task for doing so. My honesty in my personal business at best has been questioned and at the worst I have been called a liar, a cheat and a hypocrite. The pot calling the kettle black if you will. It is interesting that those who

use the pot/kettle analogy have yet to show that the kettle is white, they only claim that the pot is black.

In response to these accusations I will be sharing personal documents about myself that I would not post about Don Estep even if I had access to them. I posted only documents that are either public knowledge or church property. Local newpapers print lots of things I am sure some would rather they did not. Bankruptcies, traffic violations, DUI, etc. I have not posted private SSA communication, tax returns, etc. of Don Estep because these are not for public consumption.

As for myself I will be posting the following:

- Proof of my handicap (reason for receiving disability)

- Written communications with the SSA concerning my earnings from being self employed

- Excerpts from the SSA regulations showing how I comply with the law

- Details of how my wife's business is setup and my relationship to it

- Details of both how much I earned last year from my contract work for Automata and how much my wife earned as owner of the business

- Net income of Automata for 2005

What I will not be posting about myself are items that could cause identity theft due to the nature of the Internet. I will not post tax returns, SSN, bank statements, etc. I am sure there will be those who will not be satisfied with the data I provide. They will say "Well, you just pocket the cash and don't report it". To them I say "Report me to the Elizabethtown, Ky SSA office. Report me to the IRS." If the detailed documentation that both I and my wife keep is insufficient to convince them that we have nothing to hide, then I want to be corrected, pay what I owe and move on.

Who I am.

My name is Randell Hazel. I am married and have two boys. My wife's name is Sherry and we as a family attend The Church of God at Willisburg Ky. We live in Bardstown Ky and my wife is the owner of a computer service business called Automata. My relationship to the business I will detail later in this post. I have been a member of the Church since the age of 12 and I am now 43 years old. I was disfellowshipped from the Church of God of Prophecy because I renewed my convenant with The Church of God. I have been disfellowshipped from The Church of God because I would not acknowledge Don Estep as Kentucky Overseer. My whole local congregation was disfellowshipped in one fell swoop for the same reason.

My work history

While I was obtaining a Bachelor of Science I drew SSI during the school year. This was due to the fact I was "legally blind". During the summers I obtained a summer job to help with education and did not receive SSI when I was employed. After graduation I discontinued SSI and obtained a job with the DOD. I worked for the DOD for 12 years in various engineering positions. I then went to work for DuPont Photomasks as a Information Technology (Computer) professional and was employed with them for 6 years. The plant where I worked has since been closed and I was downsized. After paying into the Social Security system for 18 years and being out of work I decided to apply for Social Security Disability to survive while trying to find another job. After a year of no luck finding a job my wife and I decided to move back to Kentucky and try self employment. I had the technical knowledge and my wife had the business knowledge so we would give it a try. That is where it now stands.

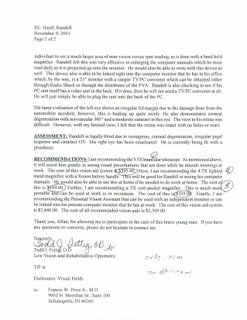

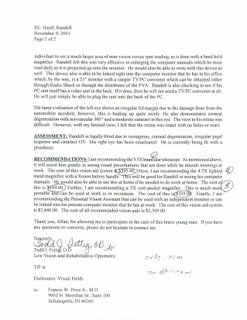

What makes me eligible to draw Social Security Disability

Two things. One is that I was born "legally blind". The second is that I paid into Social Security for 18 years. SSD is not the same as SSI. The following letter is one of many that I have received over the years that certifies from a medical professional that I am legally blind.

You can find what the SSA considers "legally blind" on page 47 of the "Redbook" at the following link.

SSA RedbookIn 2001 I was involved in a car accident the caused me to completely lose my right eye. I wear a prosthesis for looks, but I have only one functioning eye. I worked at my job at DuPont Photomasks for 2 years after that accident, but after being downsized and unable to find a job I did what I had to do, I applied for SSD.

How can you work and draw SSD?

Once again SSD does not have the same rules as SSI. Also the rules for those drawing SSD who are "legally blind" are different than those drawing SSD who have normal vision. The SSA wants those on SSD to find "Substantial Gainful Activity" or SGA. The SSA determines what I am allowed to make and still draw SSD. I have to report my earning to them and keep them informed of any changes that will affect my SSD.

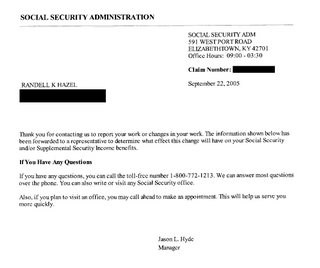

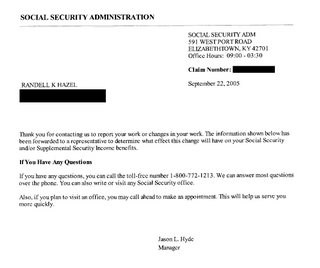

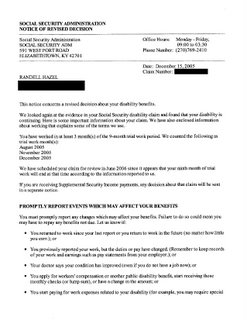

The following letters are examples of the "Up Front" communications I have had with the SSA since day one of being self employed. The first letter is their acknowledgment of my reporting to them my work status had changed.

The second letter is the SSA requesting the required information about my working so that they could determine if I have entered the work trial period and if I am making enough money for it to be considered SGA.

The information I send to the SSA is contained in their form SSA Form 820 "Work Activity Report" A sample form can be viewed at:

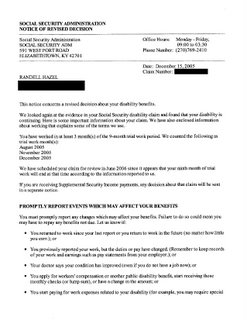

SSA Form 820The third letter is the SSA sending me their findings as to my status. They found that I have completed some of the Work Trial Period and that my SSD will continue. The third page of the letter details what I am allowed to make and still receive SSD.

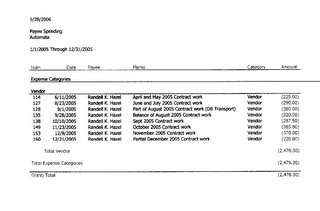

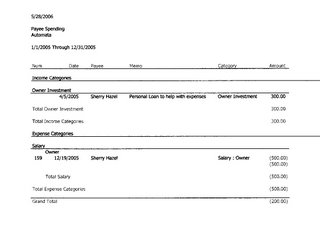

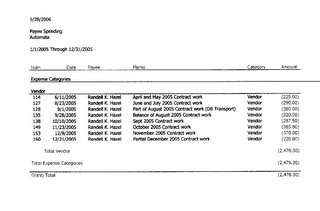

As you can see I have provided all the information that the SSA has requested and am still eligible to receive SSD. The information about how much I made since starting work is shown in the next illustration.

This is the information I provided to the SSA. I have details available to the SSA such as customer invoices, pay stubs from Automata, etc. which show a clear and precise trail of the hours I have worked and have been paid for.

How is Automata setup and what is your relationship to it?

My wife Sherry is the sole proprietor of Automata and has all exclusive control of the company and all it's assets. I am a independent contractor to Automata and am paid on an hourly basis. I have no access to any of the business assets. We hired an attorney to create a contract between Automata and myself in order to ensure clarity to the SSA and the IRS of what I am paid. The rates are based on what the market will bear in Nelson County in Kentucky. Automata has hired a CPA to do the business taxes and to ensure we are completely within the law and that all our affairs are open and transparent to the IRS. Because I am an independent contractor to Automata I pay for my own liability insurance so that any inadvertant damage I do to a client's equipment is covered.

It has been said that basically I do all the work and the business is my wife's in name only. The SSA rules say that my wife is free to make whatever she can and it will not affect my SSD. This is what my critics say we are doing. I do the work, my wife keeps the money, my wife does nothing to earn what the business pays her and we sneak the money into the bank. Sherry does ALL the following:

- All paperwork (Billing, Invoicing, Collections, Purchasing, Bookkeeping, etc.)

- LAN and phone cable terminations (I can't see well enough)

- All printer mechanical repairs (you guessed it, I can't see well enough)

- All web design (no I can see good enough, just not good a graphics design, actually I dislike it as well)

- Provides all transportation (once again, I can't see well enough)

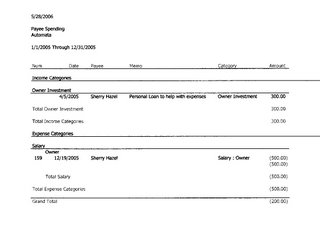

I could go on but you get the drift. Sherry EARNS what she gets. Lets look at what she got paid last year.

Anybody who knows ANYTHING about running a business knows that the owner gets paid LAST. Employess, contractors, vendors, creditors, etc. all come first and the owner gets what is left over. If Sherry and I were really trying to lie to the SSA and steal some money why didn't we make me the owner and her the contractor or employee? I could have done MORE work and claimed all kinds of expenses, paid her an inflated hourly rate and justify me making "zip" with "Well the business just isn't doing well". Our business, our earning, our setup are all known to the SSA, the IRS, our attorney and CPA. What more can we do to try and be legal and ethical?

Because Automata has only been active for about a year it has made very little profit. For example, Automata's net profit for 2005 per our CPA was $1,129.

The Bottom Line

I have provided as much information as I can without compromising my financial security. Will it be enough to satisfy the "hard core" Estep supporters who accuse me of being a crook. No, it won't be enough. They will just respond with "Well, this is all just a smoke screen to enable you to steal from the SSA". To them I say:

- Report me to the SSA Office in Elizabethtown Ky, ask for Ms. Chancellor. Per the letters from the local SSA office she is my contact.

- Report me to the IRS

I will let the SSA and IRS see any records they want and put them in contact with my attorney and CPA.

Once again, Don Estep's supporters are not interested in the truth about me, they only want to REDIRECT your attention away from him.

This picture is a scan of the "Prefatory Notes" of the 101 General Assembly Minutes. I don't know if Bishop Smith wrote these notes, but his name appears above them so I guess he at least agrees.

This picture is a scan of the "Prefatory Notes" of the 101 General Assembly Minutes. I don't know if Bishop Smith wrote these notes, but his name appears above them so I guess he at least agrees.